Why This Pandemic is Not Like the Housing Crisis In 2008

Addressing the Suze Orman Quote

By Real Estate Coach and Speaker Darryl Davis, CSP

On July 5, 2020, Suze Orman put up a post about how she was absolutely certain buyers should wait until Fall to buy a home, stating how this housing crisis was the same as it was back in 2007 and 2008. She talked about the layoffs due to COVID-19 and how there will likely be several foreclosures, and how those would severely lower the housing prices of the neighborhood.

I wanted to respond to this because you may come across buyers and sellers who read her posts and have questions and concerns about the housing market right now. You can watch the full video response here.

Recap of 2008 Housing Crisis

What happened in 2007 and 2008 is nothing like what is happening right now. Back then, there was no underwriting of mortgages, so all these people who had no income, no assets, and no business buying a house were given no-money-down mortgages and bought homes they couldn’t afford, over-extending themselves. In fact, it was a running joke, “If you could fog a mirror, you could get a mortgage!”

All those people were buying up homes and the home prices blew up, creating this real estate bubble. Suddenly, the bubble popped and they couldn’t pay their mortgages and scrambled to sell their homes, but there were no buyers left. They would lower their price, but the home was worth far less than their mortgage amount owing, and people were forced to foreclose.

Now, conversely, the banks have extremely strict underwriting rules, and require a very high credit score before lending money. It can be argued that it’s harder to get a mortgage now than in the past.

Foreclosures Aren’t Sales

Suze goes on in her post to discuss how, if a house that is worth $300,000 forecloses at $150,000, that is going to severely drop the value of the other homes in that neighborhood, but that is incorrect. A foreclosure isn’t considered as a sale, so when appraisers are looking at the market value of homes in that area and they look at home sale prices, that $150,000 isn’t going to show up in the CMA, much less drop the market price.

Also, do you think a bank is going to turn around and auction the house off for $150,000? Heck no! And if we’re going a little further, do you think anyone is going to foreclose on their house for only half of what it’s worth if they only missed 6 months’ worth of payments? No! They might sell it for less than it’s worth, but it’s not going to be a significant amount less, and once the bank completes the auction, THAT is when it becomes a sale.

An Analogy to Use with Clients

In the medical world, there are general practitioners and there are specialists. If I started having pains in my chest and I went to my GP, he would tell me that I need to go see a heart specialist, because that’s what they do — it’s their area of expertise.

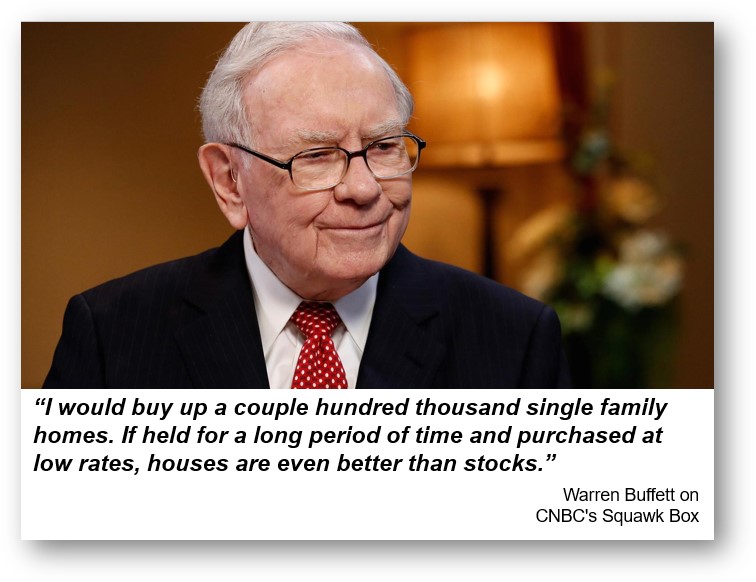

Suze has helped a lot of people, and she has some great ideas and fantastic concepts, but she is like the GP of real estate. She helps people with their small money problems, and she is great at what she does. However, let’s take Warren Buffet as an example. He has big money, and thus big money problems — he isn’t going to go to Suze for financial advice because it isn’t her area of expertise.

For your clients that are concerned about what she has stated in her post, you can reassure them that while Suze is great at what she does, when it comes to real estate, YOU are the market expert they should be talking to.

Ready, Set, Go!

Ready to start taking things to the next level? Don’t be led astray by the GP’s of real estate but invest in training that will quickly make you a real estate specialist!

Get the Darryl Davis Newsletter!

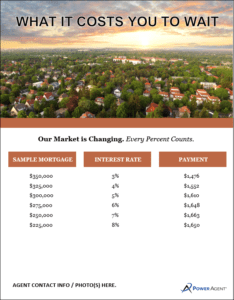

Power Agents, you’ll tons of prospecting tools for motivating both buyers and sellers to make the decisions that are right for them! Head to the Buyer’s tab to get this powerful “What it Costs You to Wait” tool. You can download and customize with your contact information. Save as a jpeg to upload to social media – or a pdf to send to people who are on the fence!

Not yet a Power Agent®? Click here to learn more about how you can access hundreds of marketing, prospecting, and objection handling tools – live weekly coaching, podcasts, webinars, and more!

Need help? Contact our team today at (800) 395-3905!